Medicaid is a highly popular program that provides health insurance to low-income Americans through a combination of state and federal funding. According to the health policy think tank FFF, more than 60% of Americans know who have benefited from Medicaid or are registered with themselves. Therefore, the talk of changing programs usually meets strong opposition.

One example is the lesser-known habit of the Medicaid system, allowing states to artificially inflate Medicaid costs to recover more federal dollars. The arrangement allows some states to pocket a percentage of money paid to provide care to Medicaid patients.

How does this work?

loophole

When a Medicaid patient receives treatment or services, the state pays to a doctor, hospital, nursing home, or other provider. The federal government will reimburse states for a portion of their Medicaid costs. Refunds range from 50-76.9%, depending on the state’s income level and other factors.

So, if a state has a 60% refund rate and spends $10 billion on Medicaid services, the federal government will reimburse the states $6 billion.

This is generally speaking, how the system was designed to work in 1965.

By the mid-1980s, some states found ways to sacrifice the federal government to increase their payments to providers and their own Medicaid costs.

First, health care providers voluntarily agree to donate money to the state or pay taxes. The state then returns the amount of donations or taxes due to increased refunds. Finally, the state charges the federal government for an increase in costs.

For example, a hospital might agree to pay the state $10 million in taxes. The state could increase Medicaid payments to the hospital by $20 million. If the state’s reimbursement rate is 60%, you’ll receive $12 million in federal Medicaid funds.

Along with tax revenue, the state will receive $22 million, pay $20 million and earn $2 million for additional Medicaid costs or other purposes.

The arrangement benefited providers by increasing refunds, while the state benefited by reducing costs and increasing revenue. The federal government had an increase in those costs.

Congress discussed the issue in 1991.

Lawmakers who supported maintaining the arrangement in one way or another claimed it became a crucial part of the state’s Medicaid funding.

Rep. Raymond McGrath (RN.Y.) said that elimination of the system would cost a federal matching fund of $500 million. He predicted the “chaos” of the Medicaid system if provider taxes were to be abolished.

President George H.W. Bush’s management strongly opposed taxes in a position statement, saying, “The state’s donations and provider-specific tax programs, if checked, undermine the basic premises of the Medicaid program. The state is betting on the costs of the program.”

Ultimately, Congress chose to impose restrictions on provider taxes and donations.

First, provider donations to the state are strictly restricted to prevent abuse. Second, state taxes must meet certain conditions or states lose federal funds.

Taxes should apply to all providers of a particular class, including Medicaid patients, as well as nursing homes. Furthermore, the State cannot provide a direct or implied warranty to providers that they will refund the amount of tax. The provider tax limit is 6%.

Here’s how provider tax works now:

Tax increase, dependence

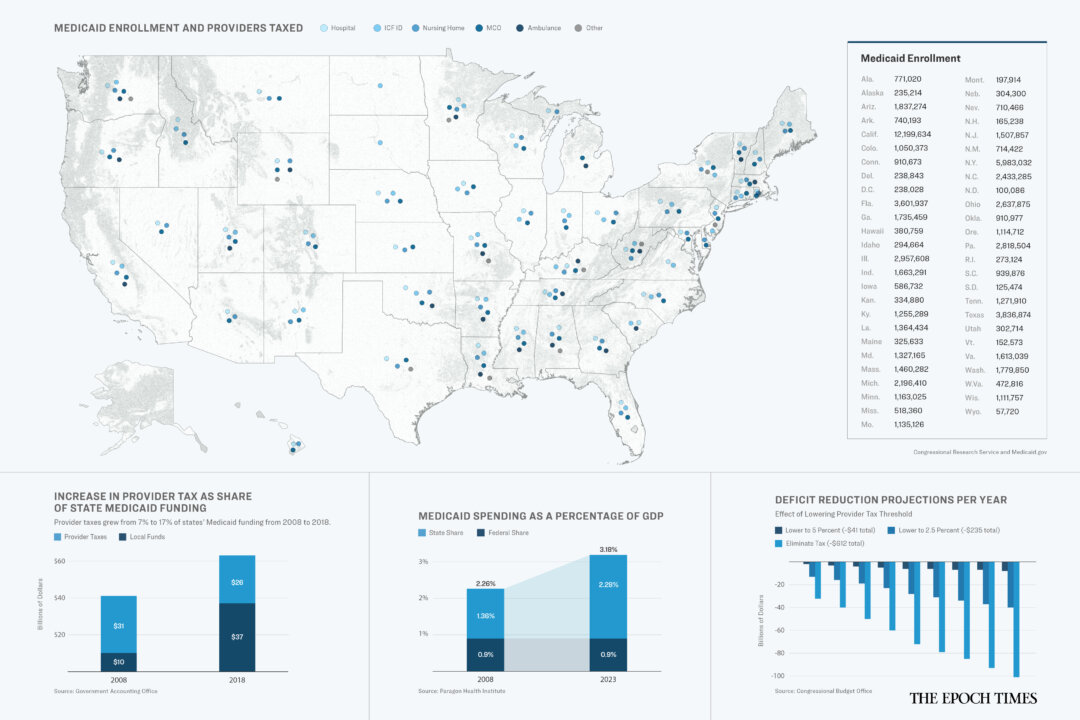

In 2004, 35 states had taxes on health care providers. Today, all states other than Alaska, like the District of Columbia, are taxing some providers.

The state relies more on tax revenues to fund Medicaid and others that agree with the Government’s Accountability Office (GAO).

From 2008 to 2018, GAO said Medicaid spending in states subject to provider tax increased from 7% to 17%.

In 2018, the state’s provider tax and local government funding received $63 billion, according to GAO estimates. Of that amount, $16 billion (25%) was not used to pay the provider.

This has shifted 5% of Medicaid costs from states to federal government, GAO estimates. The practice also reduced overall refunds to some providers when tax payments are taken into consideration.

The burden of providing Medicaid remained the same from 2008 to 2023 when measured as a percentage of Gross Domestic Product (GDP), a common measure of the country’s gross wealth.

However, the overall cost of the programme has increased dramatically. This means that the federal government has paid in full for the increased costs of the program over 15 years, according to Paragon.

Over the same period, the federal percentage of Medicaid total costs increased from 60% to 72%.

Possible changes

Republicans looking for ways to reduce federal deficits have been placed on the House Committee on Energy and Commerce, finding $880 billion in savings over the next decade.

Changes to the program are being discussed as Medicaid accounts for 92% of the spending administered by the committee.

Lawmakers came up with ideas such as limiting how much the federal government would refund states and reducing the percentage of refunds.

House Speaker Mike Johnson (R-La.) said he would not do either. “We’re talking about finding efficiency in every program. Rather than cutting down the benefits of the people who deserve them, Johnson said in a February 26 interview with CNN.

This has led some lawmakers to see provider taxes.

The CBO has found that elimination of taxes will reduce the federal deficit by $612 billion over a decade. Reducing taxes to 2.5% would reduce the deficit by $241 billion, while reducing it to 5% would result in a $48 billion reduction.

“Republicans are trying to enact the largest Medicaid cut in American history. We need them to put pressure on them in every community across the country,” minority leader Hakeem Jeffries (Dn.y.) said in a video call with a Democratic leader on March 5.

Unknown influence

The use of state taxes to promote Medicaid refunds had critics on both sides of the aisle. Former President Joe Biden, in his book The Price of Politics, called state taxes on health care providers “fraud,” according to Bob Woodward.

Others have defended the device as a way for cash-bound states to continue Medicaid. As the CRS points out, provider taxes help states increase reimbursements to certain types of providers, such as hospitals and nursing homes.

Tax use tended to increase during and after the recession. “Medicaid providers’ tax revenues can provide a way for states to continue funding Medicaid programs in an era of state budget constraints,” according to the CRS.

However, it is unclear how much state taxes are restricted on health care providers will have an impact on Medicaid.

Eliminating all taxes from healthcare providers will reduce federal Medicaid payments by about 8% over a decade, according to the CBO. A reduction in the tax rate results in a 0.6-3% reduction.

“I don’t think it’s enough money to help the state want to cut down their (Medicaid) expansion population,” Paragon Health Institute’s Niklas Kleinworth told the Epoch Times.

Kleinworth theorized that the state would likely cut funding for what is called social determinants of health, such as household modification, medical transport, and education.

“We’ll probably see that the state is making the Medicaid program more efficient,” Kleinworth said.

According to the CRS, the total amount of provider tax revenue used for Medicaid spending is not fully understood, so it is difficult to predict the true impact.

Focusing on that fact, GAO recommended five years ago that the Centers for Medicare and Medicaid Services should gather complete and consistent information about all funding sources used to raise Medicaid, including provider taxes.

As of February, no recommendations have been implemented.