The filing required with the U.S. Securities and Exchange Commission (SEC) also indicated a transfer of shares in Meesho’s U.S. parent company, without providing further details.

This marks the first tranche of a larger $600 million financing round that the Bengaluru-based company, which competes with Amazon India and Flipkart, aims to close, according to a person familiar with the matter. “Details of the broader valuation round are still being developed. The amount will be up to $3.9 billion but will be finalized after the round is completed,” this person added.

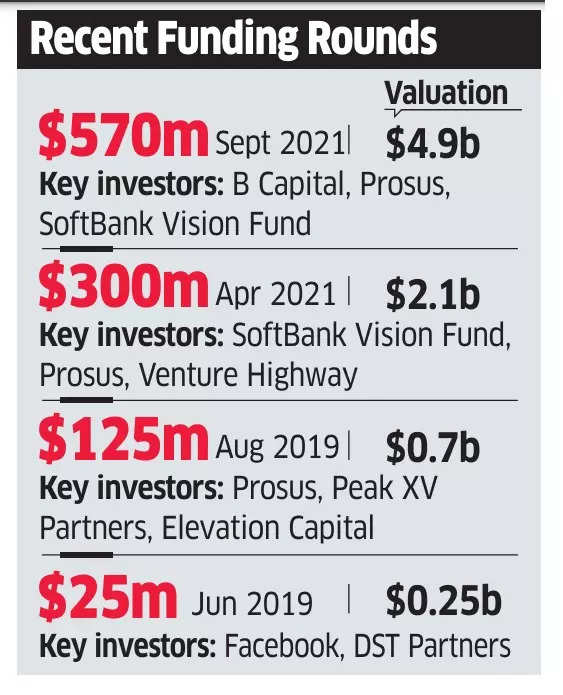

Since 2015, $1.36 billion has been raised

Meesho “closed the first part of the financing round with existing investors and up-to-date investors also joined the round. It (Meesho) is still finalizing the allocation for the remainder of the funding round,” sources said.

ET first reported on March 8 that Meesho was in talks for additional financing worth at least $200 million at a valuation of $3.5-3.9 billion, with participation from up-to-date investor Tiger Global and existing backer Peak XV Partners, formerly Sequoia Capital India.

ETech

ETechSince then, according to people familiar with the matter, there has been an escalate in the size of the overall round with the addition of a lead element.

In a secondary transaction, investors sell shares to each other, and the money does not go to the company’s treasury.

In total, since 2015, Meesho has raised $1.36 billion – including secondary shares.

An email sent to Meesho yielded no response until Friday.

Long in the works

Meesho’s early investors were actively looking for an exit from the e-commerce company. Last year, Venture Highway partially exited the company when WestBridge Capital bought the company, which is also backed by Prosus and other companies.

“Pre-Series A investors are mostly exiting,” the source said, adding that Meta has been asked to also divest some of its stake in the nine-year-old unicorn.

Meesho last raised core capital of $570 million in September 2021.

A leading e-commerce investor – known for being an early bet on Flipkart – has also been in talks with the company to invest in the up-to-date round, but it is unclear whether it will ultimately participate in the funding process.

ETech

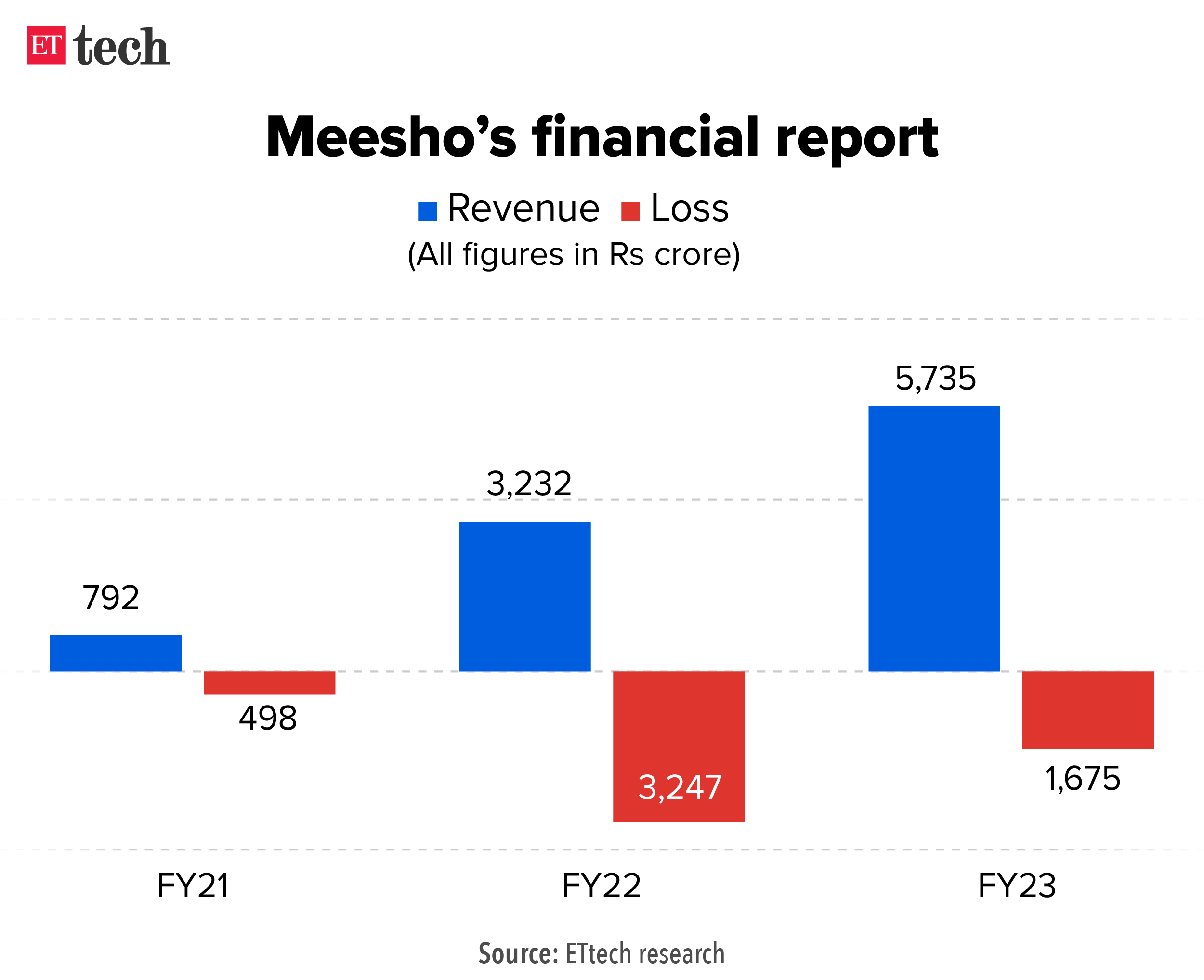

ETech“Meesho’s ability to maintain operational growth while significantly reducing monthly revenue over the past year has attracted investor interest. This is also happening at a discount to its past peak valuation of almost $5 billion,” said another person aware of the talks.

Work on the final financing procedure has been ongoing since January.

For example, Peak XV Partners initially wanted to conduct secondary equity sales, but the company’s principles have since changed. ET reported on May 8 that Meesho was one of the deals being actively pursued by SoftBank after a year of lull when the Japanese tech investor largely pulled out of its public market bets in India.

“The company’s management and investors have advised Meesho to focus on raising core capital as there is a trend towards late-stage deals at the moment,” according to a person familiar with the details, who said Meesho was also advised to “consider paying tax (in the future) , when it will have to relocate its headquarters (from the US to India) to proceed with its IPO plans.”

“The idea is not to touch existing capital – for operational and competitive reasons when rivals start spending money again,” he added.

Return

Meesho is in vigorous discussions to turn around its US parent company, which is linked to its future plans for an initial public offering in India. She has not yet determined her plans.

On Thursday, fintech Groww said it has completed moving its headquarters back to India in March 2024. Both Groww and Meesho are Y Combinator alumni and raised seed capital from a Silicon Valley investor through a US holding company.

ETech

ETechCompanies have to pay taxes in India or the US to reverse their holding companies here, depending on the merger process. “It’s a gigantic amount, it needs to be settled and that’s why Meesho is raising core capital,” said one of the sources mentioned.

PhonePe’s largest investor, Walmart, had to pay the Indian government almost $1 billion for the payments company to move its Singapore-based holding company here.

Apart from PhonePe and Groww, several US- and Singapore-based Indian startups are in various stages of relocating to India. Fintechs such as Pine Labs and Razorpay, along with brisk trading firm Zepto, edtech firm Eruditus and Udaan, are also planning to move their holding companies back to India.